Consumer Duty is a regulatory framework introduced by the Financial Conduct Authority (FCA) to raise standards of customer protection across financial services. It requires firms to deliver good outcomes for retail customers by considering their needs, characteristics, and objectives throughout the product lifecycle.

At Financial & Legal, we see this not just as a compliance requirement, but as an opportunity to strengthen our customer-first culture and ensure our products consistently deliver value and clarity.

The Duty is built around four key outcomes:

These outcomes are underpinned by three cross-cutting rules:

All staff here at Financial & Legal Services are expected to act in accordance with these principles, with accountability embedded across our governance and oversight structures.

Consumer Duty aligns with our commitment to delivering products that are not only compliant but genuinely beneficial to our customers. It reinforces our belief that good governance and commercial success go hand in hand.

We’ve embedded the Duty into our business strategy, product governance, and oversight processes. This includes:

At Financial & Legal, we define a good customer outcome as:

“A product, service or interaction performs in a way the customer would reasonably expect, with minimal risk of financial detriment, distress or inconvenience.”

This underpins everything we do, from product design to claims handling and guides how we monitor, assess and improve our performance.

We assess good outcomes using a structured framework that includes:

These outcomes are monitored through data analysis, customer feedback, complaints trends, and distributor reporting. Where gaps are identified, we take action whether that’s improving a product, updating communications, or refining our support processes.

We expect all third parties involved in the development, distribution, or servicing of our products to uphold the principles of Consumer Duty. This includes:

Our contracts and oversight processes are designed to ensure clarity of roles and responsibilities, with proportional expectations based on each party’s influence over customer outcomes.

Our product governance framework ensures that all products are designed, approved, and monitored to deliver fair value and good outcomes for customers, in line with regulatory expectations and internal standards.

At Financial & Legal, we design and review our insurance products to ensure they are suitable for the customers they’re intended for. This means:

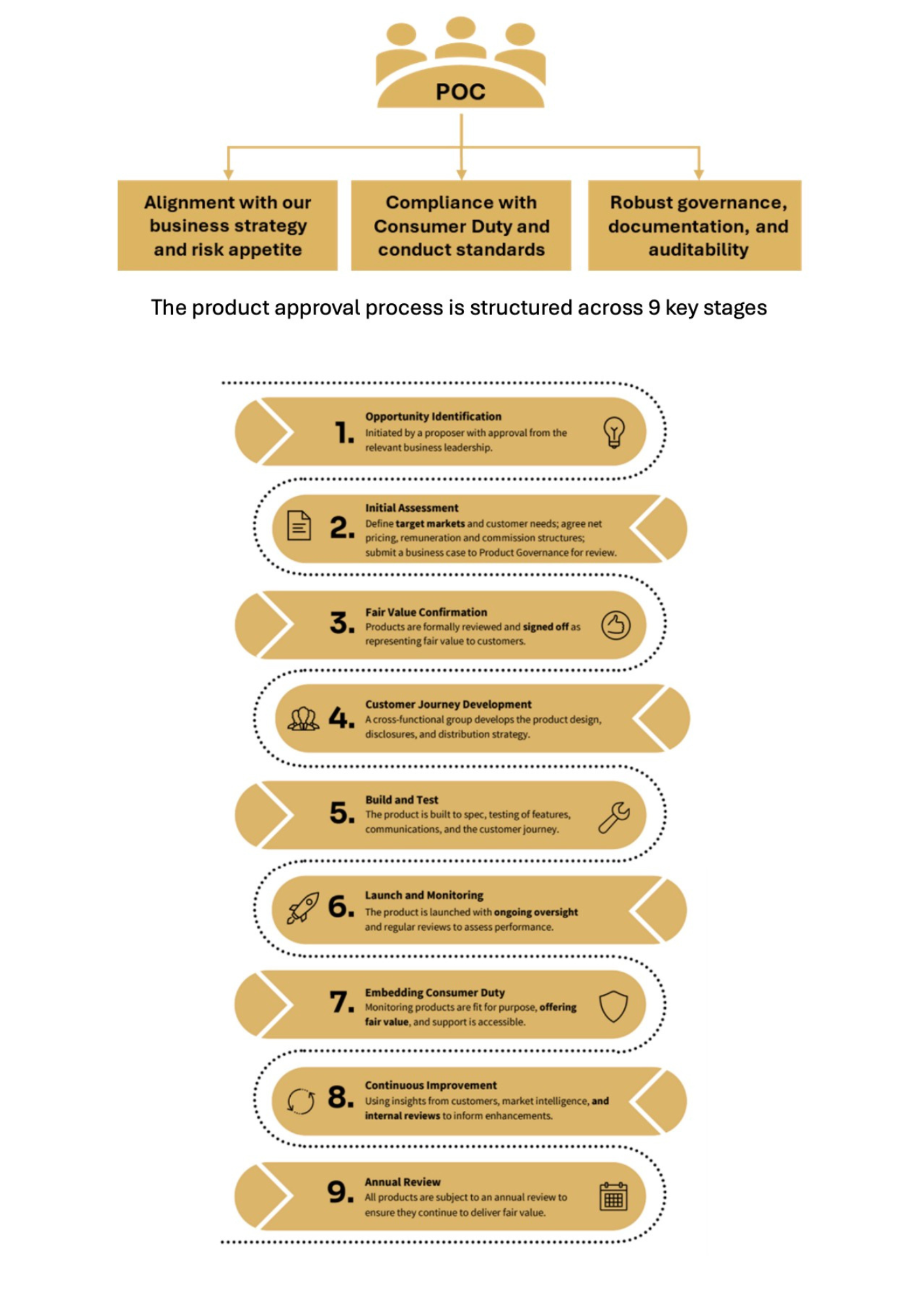

All new and significantly amended products undergo a formal approval process, overseen by our Product Oversight Committee. This includes checks for:

We also carry out annual Fair Value Assessments. These reviews help us identify where improvements are needed, whether that’s redesigning a product or removing one that no longer delivers value.

Our governance framework has been independently assured to meet FCA expectations, giving customers and partners confidence in our approach.

Our fair value assessments consider:

If an assessment indicates that a product may not offer fair value, we take swift action, this could include withdrawing the product until improvements are made. Outputs from these reviews are shared with our partners across both wholesale and retail broking channels.

Our Product Governance framework makes sure product wording is clear and coverage is easy to understand. We are actively reviewing all customer communications, including financial promotions, to confirm they are fair, balanced, and not misleading.

Through our Consumer Duty programme, we check that communications are:

We assess the effectiveness of our disclosures using readability checks to support informed decisions. When improvements are needed, we update materials to help customers make better choices and maintain transparency.

We’ve mapped the full customer journey across our products and services, including interactions via intermediaries and third parties. This helps us identify key touchpoints and ensure customers receive appropriate support, tailored to their needs, the complexity of the product, and our role in the distribution chain.

We continuously monitor customer support through:

Where gaps are found, we take action to improve consistency and ensure our standards are upheld across all channels.

At Financial & Legal, strong product governance is central to delivering fair value and good customer outcomes. This is underpinned by a robust set of policies, procedures, and controls that are regularly reviewed and updated to reflect changes in regulation, market trends, and customer expectations.

We engage stakeholders from across the business in governance activities to ensure that decisions are informed by a wide range of expertise and insight. This collaborative approach supports effective risk management, continuous improvement, and the delivery of products that consistently meet the needs of our customers in a dynamic environment.

Our Product Oversight Committee (POC) provides strategic oversight and challenge throughout the product lifecycle. The POC’s remit includes reviewing product proposals, assessing customer outcomes, and ensuring that appropriate controls are in place across the product lifecycle.

At Financial & Legal, comprehensive product governance forms the foundation for delivering fair value and positive customer outcomes. This commitment is supported by a rigorous framework of policies, procedures, and controls that are routinely evaluated and updated in response to regulatory developments, market evolution, and shifts in customer expectations.

Stakeholder engagement from all areas of the organisation is integral to our governance processes, ensuring decisions benefit from diverse expertise and perspectives. This collaborative methodology enhances risk management, drives continuous improvement, and enables the consistent provision of products tailored to our customers’ needs in a rapidly changing environment.

The Product Oversight Committee (POC) exercises strategic oversight and provides challenge across all stages of the product lifecycle. Its responsibilities encompass reviewing product proposals, evaluating customer outcomes, and verifying that robust controls are maintained throughout each phase of product development and delivery.